Strategies That Help You Save Thousands on Your Annual Business Insurance

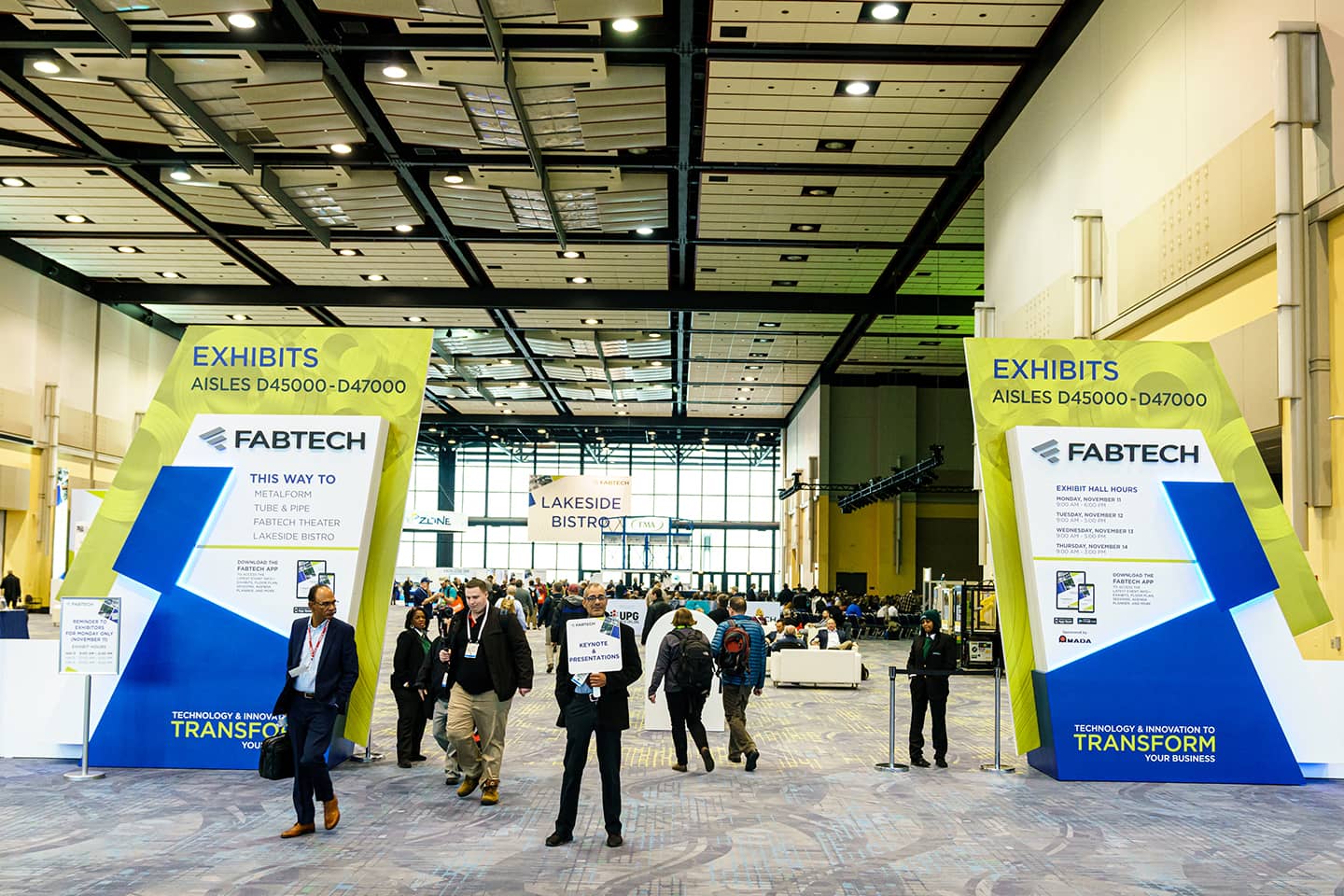

We’re happy to have this week’s guest blog from Bill Morway of Market Financial Group. Bill will present at FABTECH 2015 in a New Session: Risk and Asset Management: What You Need to Know!The annual spend on business insurance can be significant. Past claims experience, safety/ risk management practices, hiring practices, choice of insurance broker/agent, etc. can all impact those costs. Click here to view a sample Experience Mod sheet for an Illinois firm whose Work Comp insurance renewed on August 23, 2015. A sheet such as this is sent to most every business in Illinois, unless they are too small to be what is called “experience rated”. A business normally gets this sheet 90 to 120 days before their Work Comp policy renewal date. Our example firm here generated a .97 Mod (anything below a 1.00 is favorable / anything above a 1.00 is unfavorable, as far as affecting your premium) . . . but it possibly could have been better. We are going to focus on the data that is used to generate that number. As you look at the data you will see that 3 years of claim data is used. What is the significance of the 3 claims that you see highlighted? They are all OPEN claims. This sample firms’ mod was calculated with data on hand at the NCCI as of Feb 23, 2015. (6 months before the renewal date). The NCCI (National Council on Compensation Insurance) is the governing body regarding Workers Compensation rates and rules in most states. The $ 64,000 question is . . . . Did this guy’s Work Comp insurance broker make any effort or attempt in the days leading up to Feb 23, 2015 to get the insurance company to close any of these claims or at least reduce the reserves? Come learn how this strategy (and others) might save you thou$and$ on your insurance spend during Bill’s session at FABTECH on Tuesday, Nov. 10 from 8:00 am- 10:00 am. Learn more here.